Risk Rating: Scoring Challenges and Solutions

Risk rating is a complex scoring system, which relies upon previous experiences and foresight to anticipate risks that might impact the smooth functioning of business. When risks are well managed, a business can maximize opportunities and control the impact of disruptive events. Alternatively, if a risk is underestimated—or not anticipated at all—a business can suffer significant economic or reputational damage as a result of this unpreparedness.

What is the Purpose of Risk Rating?

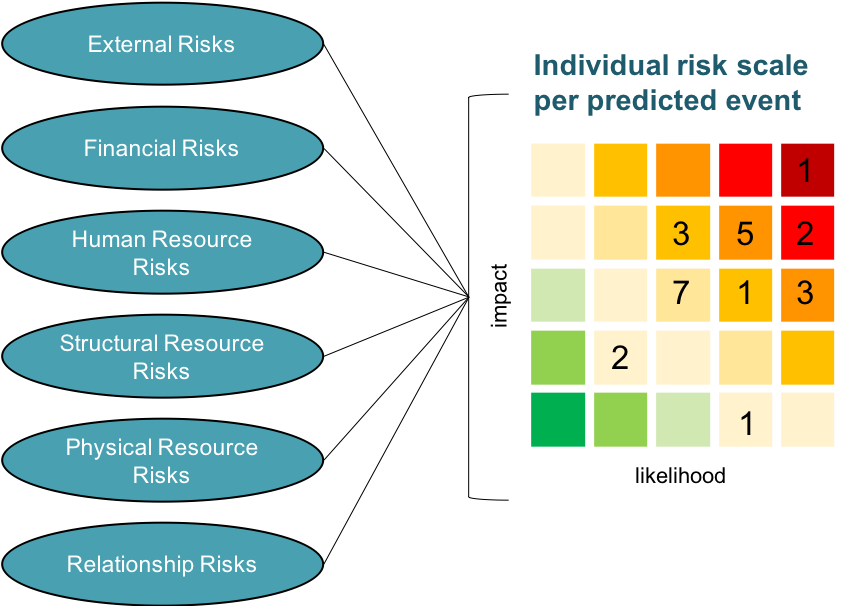

Businesses use risk rating to assess the risks involved in an activity. The goal is to anticipate and classify potential risks as low, medium or high based on the expected impact and the likelihood of such an event occurring in the near future. This allows businesses to adopt control measures that can help cure, mitigate or remove the anticipated impact of the risk.

In situations where risk cannot be controlled or removed, a business may choose to accept the risk or cancel the activity. This decision depends on the likelihood of the risk event occurring and the expected severity of the impact.

Why is Risk Rating a Challenge?

Experience and historical data are useful references when rating the probability and impact of risks that have happened before and may happen again under the same set of circumstances. The bigger challenge is managing unknown risks. Obvious examples include Covid-19, the economic meltdown of 2007-2008, the Fukushima nuclear accident. Unknown risks typically form through complex interdependencies and dynamics that are not fully understood until the event happens.

Human imagination is limited in such cases. Further, humans have a tendency to underestimate the probability of an outlier event or downplay the expected impacts. Even as the economic events of 2007-2008 were unfolding, the US Fed’s risk model did not predict the scope or severity of the resulting recession. With Covid-19, scientists warned governments and healthcare to prepare for the possibility of a coronavirus pandemic, but most did not have sufficient plans in place to contain the health and economic impacts of the virus.

The unexpected impacts of climate change provide another example of how domino effects can catch entire industries and governments off guard. Extreme weather events are causing slowdowns across major supply chains. And rising temperatures are threatening the safety of water supplies. As the world becomes more globally connected and the pace of change intensifies, it will become even more difficult to anticipate the full range of risks that need to be managed.

How Can a Digital Twin Help Improve Risk Scoring?

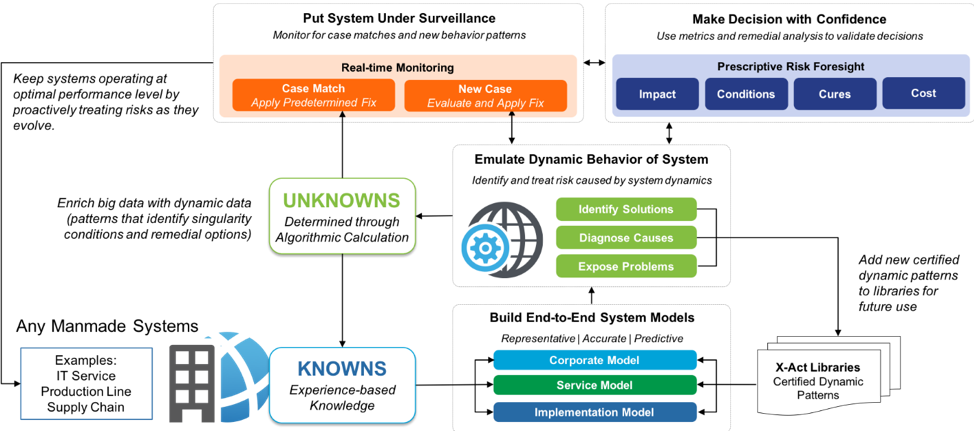

A digital twin provides a software representation of a physical asset, system or process designed to detect, prevent, predict and optimize the system being studied through real time analytics. Digital twins created within X-ACT include time dependent behaviors, which is key if you want to accurately model the dynamics of assets that change over time—for instance aging or cyclical changes that may impact performance.

Using the digital twin to perform stress testing and sensitivity analysis allows users to quickly identify any conditions that might cause a physical asset to deviate from its expected behavior or find the root cause of problems. As risks are revealed, fixes or controls can be identified using the digital twin and implemented when needed. Users can also gain confidence in decisions and see how different choices playout under various conditions. This is particularly useful to predict the outcome of scenarios that would be difficult, costly or even impossible to test in the real world.

For example, a digital twin can be used to evaluate the benefit versus risk of deploying innovative technologies, like artificial intelligence, blockchain or Internet of Things. Or even help rate the risk of a new business activity, like funding loans for smart city projects, when there is no historical precedent to reference.

By covering every variable which may directly or indirectly influence risk, digital twin analysis can predictively cover known risks and expose unknown risks. This arms decision makers with the missing risk intelligence they need to successfully navigate the complex dynamics and uncertainty of modern business.